Sharegenius Swing Trading (SST)

Blog last updated on: 1 JAN 2026

The Strategy

Sharegenius Swing Trading which is popularly known as SST is a great strategy provided by Mahesh Kaushik sir (YouTube channel: https://youtube.com/@Maheshchanderkaushik?si=XVrc73N6esLPBqrL).

It has been one of the

most consistent rewarding stock market strategy.

Here is a simple explanation of

this simple strategy:

- It's best suited for N100 stocks as they contain blue-chip

stocks.

- Start tracking a stock when it makes a new 20 day low

- Buy the stock

when it crosses the 20 day high

- Sell the stock when it reaches 10% profit

target

- Average the stock, when it gets triggered again as per the above rules

- If it's averaged once (total 2 buys), then reduce the profit target to 8%. If

it's averaged twice or more, then reduce the profit target to 6%.

To understand

the strategy in detail, you can watch the complete video playlist

here

******************************************************************

Useful SST Resources

Tradingview indicator for individual stocks (by Atul Kharadi)

******************************************************************

Performance of SST

One of my YouTube follower Mr Rohan Hansdak has been following this strategy in

the most disciplined way and he shares his performance results in quarterly and

annual basis. So here are the amazing results with all explanation of tweaks used by him:

SST Summary on N100 for FY 2021-2022

We did >25% which is excellent, and beaten the Nifty 50 returns which is 18% for the same year. Capital allocated 30L for SST, means still ~30% funds free.

***************************************************************************

SST Summary on N100 for Q1 FY 2022-2023

Nifty has done approx -13% from beginning of April 2022 to end of June 2022, and we have managed to yet squeeze out +2.43% returns!

May and June months were boring with handful of buy signals and sells as well.

**********************************************************

SST Summary on N100 for Q1 - Q2 FY 2022-2023

SST (10%,8%,6% targets with some more tweaks) is now the Bread and Butter no tension strategy. Nifty given -4% returns from April to Sept and we have comfortably done +8%! So yes beaten the index by a big margin. Max funds touched were 22L but currently calculated at what funds blocked on 30th Sept. Since inception(April 2021) we are averaging +2% returns monthly till date.

April, May and June when markets fell from 18K to ~15K, discipline was tested and hardly any profit bookings were done for May and June. That was covered up fully in the next 3 months. Hence I would ideally look at returns on an annual basis and not Monthly or Quarterly. People who started this April would have been shocked to see <1% returns for April, May, June, but that's where psychology and discipline plays a big part.

***************************************************************************

SST Summary on N100 for Q1 - Q3 FY 2022-2023

9 months SST summary on N100 stocks:

In this period, Nifty index given total returns of ~3.5% overall, and SST managed ~10.5% returns. Again beating the index by a good margin.

************************************************************************

SST Summary on N100 for Q1 - Q4 FY 2022-2023

SST full year performance for 2022-23. Rohan made ~11.5% returns during the time when Nifty has given nearly negative 4% returns. Hence beating the index by a big margin. No month went by without profit booking. This strategy is on full auto mode as he worked just 5 days out of 365 days (over assuming 30 mins per working day).

************************************************************************

SST Summary on N100 for Apr 2023 - Jun 2023 (Q1)

Current Notional Loss: Rs 2,61,276/- (~10.2% of funds utilized).

**********************************************************

SST performance on N100 stocks for Q1+Q2 2023 (April-Sept)

We are almost near the returns generated in 6 months this year, matching the full last FY 2022 performance!

Current Notional Loss: ~10.4% of funds utilized

**********************************************************

Rohan's SST crossed 21% returns for the current year in just 9 months!

Thanks to the recent 2 months rally, many of the long averaged stocks came out in profits and have freed up capital back as well.

The next 3 months will show if we can outdo the 2021 bullish performance too. Yes we have returns Alpha of almost 10% over Nifty 100 since SST's inception, 46% vs 55.3%

Current Notional Loss: ~4.52% of funds utilized

**********************************************************

SST Summary on N100 for Q1 - Q4 FY 2023-2024

Rohan generated an impressive 33%+ returns for the full FY 2023-24 in the Nifty 100 universe. Total 3 years SST returns have outperformed Nifty by a huge 20%+ Alpha.

**********************************************************

SST Summary on N100 for Q1 - Q1 FY 2024-2025

FY 2024-25 begins on a stellar note, with N100 SST again outdoing Nifty50 returns by an alpha of 1.5%

Also we booked profits each and every single trading day! the only tweak for the period was bookings done @6-7% for every script, and trailing again. Full Year FD returns are already locked in 3 months

**********************************************************

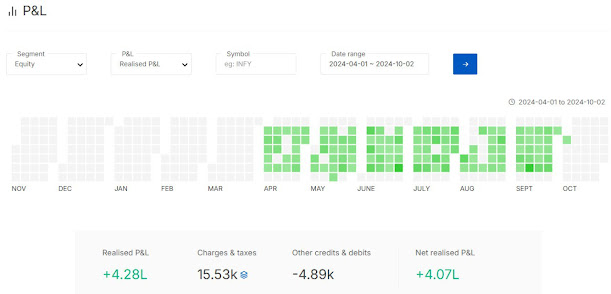

SST Summary on N100 for Q1 - Q2 FY 2024-2025

SST on N100 stocks again has outdone Nifty 50 returns comfortably with +19% odd in 2024 Q1+Q2 with a Alpha close to 4.5%.

Still 6 months to go for 2024 end. Lets see if the original year 2021 returns can be matched!

Cherry on cake was each and every single day profit booking in Sept!

**********************************************************

SST Summary on N100 for Q1 - Q3 FY 2024-2025

Once again SST on N100 universe outshining the Nifty 100 returns by a huge margin!

The current Q3 quarter was in a good bearish downtrend yet there were slow and infrequent profit bookings. But this behavior also caused us to get the biggest Alpha compared to the index ever since starting SST in 2021!...

All eyes on Q4 now...if we can generate another 4-5% returns in the coming 3 months, we are almost going to double the returns in full 4 year cycle, reaching nearly 18-19% CAGR!

**********************************************************

SST Summary on N100 for Q1 - Q4 FY 2024-2025

Finally we close 2024-25 FY and end up with another year of astounding SST (N100) performance!

Notable observations

1) 1st half of the year was almost solid profit bookings almost every trading day

2) 2nd half when N100 had almost 20% correction, we still were booking profits and ~6.5% returns were still seen in this downfall period!

3) 2024 has seen the highest yet ALPHA returns compared to the index! And also the highest seen ever since the start of SST from the last 4 years!

**********************************************************

SST Summary on N100 for Q1 - Q1 FY 2025-2026

First time in 4 years since inception we have underperformed index and it should not be surprising as markets were in free fall the previous 6 months affecting all holdings.

Profit bookings are coming in more frequently now and as index tries going higher up, we will see better results in the coming quarters.

**********************************************************

SST Summary on N100 for Q1 - Q2 FY 2025-2026

Time sure flies by. H1 2025 SST on N100 result update time!

We were behind N100 index in Q1 2025, but by Q2 we have narrowed the gap to just 0.5% Alpha!

Patience pays and hopefully we achieve 100% returns in less than 5 years which may lead to ~17% CAGR! Overall we have an alpha of over 25% since inception!

**********************************************************

SST Summary on N100 for Q1 - Q3 FY 2025-2026

Rohan's portfolio made profits but still slightly lagging behind the N100 Index returns. He is still averaging ~1% returns per month.

He remains optimistic for the year ahead, anticipating that the SST will narrow the gap and outperform the Index in the final three months.

**********************************************************